Tracking your assets

Tracking your organisations assets is not something many senior finance managers look forward to. Asset tracking is a side project that typically gets forgotten about and is seldom at the forefront of management’s minds, but for a relatively modest investment, you can unlock the full potential of your organisations assets, eliminate unnecessary spending and really sweat your assets.

What you don’t have a handle on you can’t manage, and other than the people in your organisation, what’s more important than the assets at your disposal.

What I’ve written here comes from years of experience implementing asset management systems using the Wasp Mobile Asset system, mainly in large schools and public institutions, but the experience is equally valuable in any organisation that has thousands of assets that need to be managed.

Wasp isn’t the only asset management software out there – but it is built on decades of experience mobile data collection.

Imagine…

- Having a list of assets effortlessly maintained.

- A report of what assets have been bought – and who they are assigned to.

- Hold on, this is the sixth tablet Bob has bought this year – what’s going on?

- Why are we buying another CAD printer when we already have three of them.

- The ‘calibrator’ was used 77% of the time this month – probably time to look at buying a second one.

- Van 1 and 7 are due for their annual service this month.

- The water boiler in the canteen is broken – who do we need to contact to get it looked at…

- The van was only used three times last month and the depreciation is currently at £3,000 this year – do we really need to own a van, could we just rent one when we need it? Who’s responsible for the van – it’s Bob in sector 4A – I’ll ask him about it.

- No, you can’t buy more chairs – we already have 221 of them. Go find them…

- The Ops director puts in a capex request for a particular machine – but it was only used for six days last month.

Setting up your Asset Management System Project

Assign project responsibility.

Define what success looks like. Here’s ours:

- “A comprehensive shared digital asset register including assets that are of capitalisation value or that are difficult to manage (such as computers which might not be valuable but need management).

- Relevant data in the database – such as value, purchase date, supplier (if new item with a warranty), service requirements, service history.

- Assign asset management responsibilities to an Asset Manager.

- Record of asset utilisation.

- People trained to enter the data into the asset management system.

- Data automatically synced to and from the main financial system.

- Accurate asset loan records created.

- Regular asset audits are undertaken quarterly and a review of assets undertaken.”

Perfection is the enemy of progress. You can build the database as you go and add functionality. You can choose to identify the most valuable or most important assets first and when you have that process bedded in, go back and record the rest. You’re aiming for 80% of the benefit from 20% of the effort.

Maintaining your digital asset system

Assets in – You already have a purchase order and capital purchase system. The bulk of that information from those records need to be copied across to your chosen asset database. Ask us how we can help with that – using Zapier it’s possible to link certain financial systems to a range of asset management applications.

All new assets need to be labelled and added to the asset database. That means a process where someone physically checks the asset in and applies an appropriate label or tag. They need to record where the asset is and who in your organisation is responsible for it. If this works for your organisation, once a month run an asset purchase report and go on an asset hunt with labels in hand.

Assets out – This is the most difficult part of the asset management process. You have a clear asset purchase authorisation process, but likely nothing so strict to cover disposals. The person responsible for the asset needs to be made aware of their assets being disposed of. In many cases they won’t. How do you manage this? The answer is frequent asset audits.

Loans and returns. To run an efficient loan and return system, you need a secure store and trustworthy people who record assets in and out. Practically, you could offer a self record system and undertake periodic audits to ensure the assets are being recorded accurately. An inexpensive code entry on the door and camera can confirm who is and isn’t recording the loan.

Do you like what I’ve written here? I’d love your feedback so I can make it better for new readers.

Miles Green

Undertaking Audits

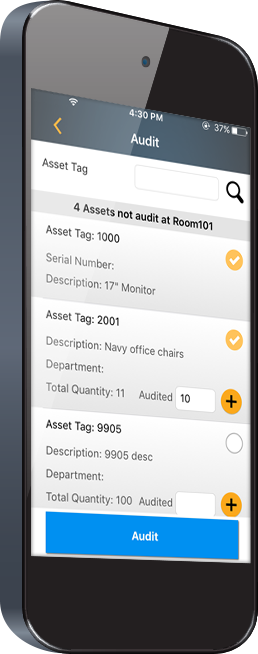

This is where barcodes turns a real headache, something you put off, into a well oiled machine. With barcodes on each asset, the same colour and located in broadly the same place, with the right software, your audit looks like this:

- Scan the room ID barcode.

- List of assets recorded in the room appears on your handheld terminal.

- Go round and scan each asset barcode.

Assets are checked off your list as you scan them. Assets that shouldn’t be in the room are reported when they’re scanned and the asset manager can move them from their old location to the new one.

Eventually you have a handful of items that should be there but can’t be found. When you know what you’re looking for it’s easier to find them. Can’t find them? Carry on with the audit and hope they reappear in different locations.

Dealing with lost or stolen assets

When your assets don’t appear anywhere in your organisation – they’ve either been disposed of without following procedure, they’ve been destroyed or they’ve been stolen. Review the list of missing items with the person responsible for them.

After a few reviews, the responsible person will ensure assets are properly disposed of or keep a closer eye on their assets. If you need to make insurance claims, you have all the information you need in front of you to make a claim in minutes.

For the first time ever, you have a comprehensive list of what’s missing and you can make informed decisions.

As the head of finance, you need these reports without the time and hassle getting the data. Following the advice in this article, you can have this.

Choosing the right asset tracking system

Choosing the right asset management software makes all the difference. You’re looking for a system that:

- Has fields that you can customise for your organisation and purposes

- Intuitive and simple so everyone, even temps or contractors can use it – imagine handing us your site plan and having us work through your locations and check your assets. Leave us to do your audit.

- Shared – so your ops manager can see what assets she has at her disposal, or managers can see what assets they are responsible for.

- Permissions – so the right people can view, but not edit records.

- Audit trail – so you can see who made what changes

- Mobile terminals – you need to be able to manage assets at the point of recording.

- Difference depreciation methods and formulas

- Cloud based and integrated with your finance system

The strength of your electronic asset register lies in the audit. If the fixed asset audit isn’t done because it’s expensive, difficult or time-consuming – your asset register, and all the decisions that go with it are flawed.

Expert Labels can help you with your asset tracking

Use us to come in and do your asset audit for you. We know how the software works and because it’s been properly set up, outside contractors like us can do the work without disrupting your department’s work.

Asset Tracking Checklist

- Who is responsible for tracking assets?

- What does success look like – have I defined it?

- Have I found a digital asset tracking system that meets my needs?

- Have I got a defined process for booking in assets?

- Have I got a disposal system for old assets?

- Have I got somewhere secure to store assets?

- Have I trained people to check loan assets in and out?

- Have I scheduled asset audits and planned to review the results?

- Have I set up useful asset reports?

- Have I trained my operations colleagues to use the other features in my asset tracking system such as maintenance records?

We are here to help. If you have a question, or you would like a would like to discuss with us, please get in touch. Email sales@expertlabels.co.uk or call us on 01359 271 111, we’d love to hear from you.

Useful Links

Read the ‘8 Tips for successful asset labelling‘ article

Learn about RFID labels here.

Last Updated: 12 Jun 2023

- Barcode Labels

- Biodegradable Labels

- Block Out Labels

- Booklet and Fold out Labels

- Cryogenic Labels

- Fan-Fold Labels

- High Temperature Heat-Proof Labels and Tags

- Label Design and Print Software

- Loop Lock Labels

- Peel and Reveal Labels

- PiggyBack Labels

- RFID and Security Labels

- Security Labels

- Sustainable Labels

Get a Free Sample Pack

-

Our Products -

More Products